Sample Letter: Request Credit Card Company to Waive Late Fees

I have been an online writer for 9 years. I love sharing tips to help people.

Most credit card companies will give you a credit card free of cost. But a few still charge a membership fee annually. Most of these credit card companies, though, will waive the fee if you know how to request a fee waiver, and through which medium to do so. Some prefer credit card holders to request a fee waiver via a phone call, but most require a request letter from your registered email ID. This remains true for late fees, as well.

Last week I was asked to send a request letter. I searched Google for a request letter template, but couldn't find one. I was forced to write the letter on my own, and I am sharing that letter here. I'm also including a sample of a letter requesting my credit card company to waive a late fee. Feel free to reference these letters when contacting your own credit card provider.

Request to Waive Membership Fee

The Manager

Credit Card Division

xxxx Bank Ltd.

London

Subject: Membership Fee

Reference: (Credit Card)

Dear (Manager's name),

This is in reference to my XXXXX Bank Credit Card No. xxxx xxxx xxxx xxxx. I have received my credit card statement dated 12/12/2000. I noticed that you have charged Rs. 2500 + tax as a membership fee.

I kindly request you to waive the membership fee and tax as a goodwill gesture to a loyal customer of yours. Many of the other credit cards I am using do not charge a membership fee.

I look forward to your confirmation that my membership fee has been waived.

Thank you.

Sincerely,

(Your Name)

(Your Billing Address)

Whether or not your membership fee will be waived depends on your bank, how you use your credit card, and your credit history. If your bank does not waive the fee, you can resort to more aggressive actions like threatening to cancel the credit card.

Request to Waive Late Fee

The Manager

Credit Card Center

London

Sub: Reversal of Late Payment Fee and Interest

Ref: Credit Card No. xxxx xxxx xxxx xxxx

Dear (Manager's name),

This email is in reference to the late payment fee and interest charged to my credit card. The dated of the charge is 14/11/2009. I have not received the credit card statement for the period from 13/09/2009 to 13/10/2009. Due to the non-receipt of the statement, I had no way of making the payment. Thus, I request that you kindly waive the late payment fee and interest charge, for without the statement, it was impossible for me to make the payment.

I have already paid Rs. 25578.23 through cheque No. 888888 dated 28/11/2009 drawn by xyz Bank, payable in London.

I look forward to receiving an email confirming you have waived the charges.

Cordially,

(Your Name)

(Your Billing Address)

In this case, I did not receive the credit card statement on time and could not make the payment. After sending the email, I explained the situation to the credit card company over the phone and they waived the late fee.

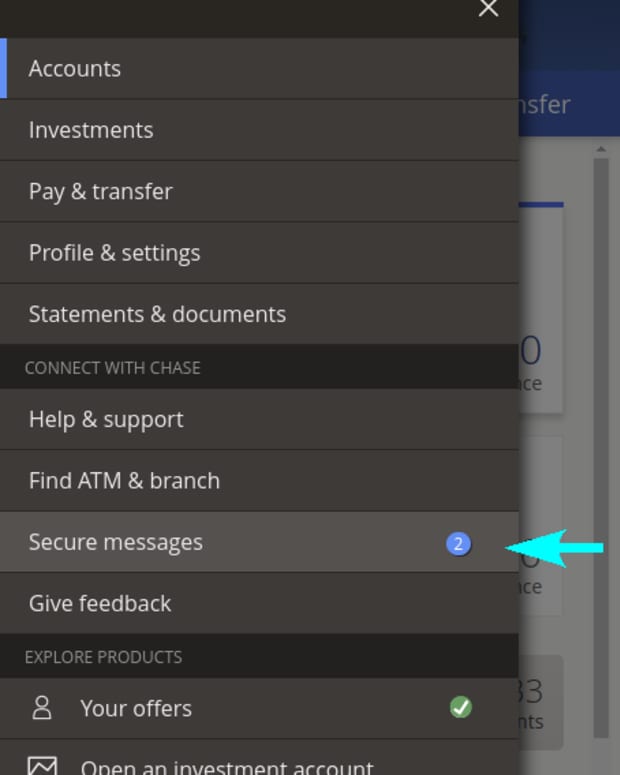

Sometimes requests via telephone do the trick, but often banks insist on letters so they have something physical to keep on record. I hope the sample letters above help you save some of your hard-earned money.

Five Things to Consider Before Applying for a Credit Card (Video)

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

Comments

SANJAY KUMARon February 18, 2020:

thank you

Jessica Lucia Angelon October 01, 2019:

Thank you

Iresha Liyanageon January 29, 2019:

thank you so much!

Buddhaon October 14, 2018:

Thank you.

Ruben Randolphon January 27, 2012:

Thanks for the tips you are giving on this weblog. Another thing I want to say is always that getting hold of some copies of your credit file in order to inspect accuracy of the detail could be the first measures you have to execute in fixing credit. You are looking to clear your credit history from harmful details faults that damage your credit score.